Creditors must leap through some legal hoops to start with right before they will commence garnishing your wages. This commonly requires suing you, acquiring a judgment, and afterwards requesting a garnishment buy through the court.

If you're feeling a judgement is not proper, it could be feasible to stop the wage garnishment. Good reasons fluctuate for an incorrect judgment. One example is, if deductions are made by your employer with no court buy or your authorization, the deduction will not be lawful.

1 Write-up facts Post specifics of the tax resolution requirements in moments, fully no cost. two Find specialists We will discover tax resolution gurus close to you and do the legwork to Get in touch with them with your behalf. 3 Get prices Get rapidly cost-free tax resolution prices from the most beneficial tax resolution industry experts in your area.

Having right lawful representation is commonly worth the financial commitment to take care of garnishment challenges as rapidly and favorably as is possible.

In the event the judgment creditor has been paid out the complete quantity of the judgment, they must file a prepared assertion telling the courtroom that the judgment has long been satisfied and supply a duplicate into the judgment debtor. Soon after submitting the statement, the clerk of court shall enter the judgment as glad.

Remember to note, all calls with the corporation, also to the corporation can be recorded for good quality assurance and schooling functions. Clientele who will be able to stay with This system, and get all of their debt settled, can see some combination of: extension of terms, financial savings on amount of money owed, and more. Not all consumers comprehensive our software for many explanations, for instance not enough money.

As soon as a creditor has acquired a judgment against you, lots of states have to have that it deliver you a person final warning letter before the garnishment begins. This will likely be called a "demand from customers letter." If you have a demand letter from a creditor, Will not dismiss it.

For those who filed for individual bankruptcy Beforehand and it absolutely was dismissed inside of a single 12 months within your recent submitting, the stay will last for 30 times. You'll be able to check with the courtroom (by formal motion) to increase this time. You'll have to demonstrate which you designed your next filing in great religion.

Once an agreement is attained, we’ll enable you to take care of the settlement documentation and transfer your payment to the creditor or credit card debt collector, supporting you keep the economic info non-public and protected. Ask for an exemption to stop wage garnishment in Maryland

This short article gives an summary of how to guard website your wages from garnishment. You will find more info on garnishment over the U.S. Office of Labor Web page. To receive info particular to your circumstance, take into account making contact with a neighborhood attorney.

For anyone who is issue to a federal tax garnishment, the amount you receive to help keep will depend on the number of dependents you have and also your conventional deduction total. State and native tax organizations even have the right to consider a few of your wages; normally, point out regulation boundaries the amount of the taxing authority normally takes

Chapter seven individual bankruptcy. The personal bankruptcy trustee—an official chosen from the courtroom to oversee your issue—will promote any nonexempt house and distribute the proceeds for your creditors.

Ignoring a lawsuit isn’t more than enough to stop a judgment. If you don’t react, the creditor could get a default judgment for that debt quantity. Each time a creditor contains a judgment in opposition to you, the creditor is sometimes called the judgment creditor so you are occasionally called the judgment debtor.

The employer have to advise the employee Just about every shell out period of the amount withheld and the tactic employed to determine the amount. This data may be supplied over the pay stub.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Tiffany Trump Then & Now!

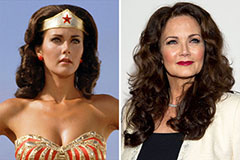

Tiffany Trump Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!